Lower Huron Shale adalah formasi serpih yang signifikan di wilayah West Virginia, dikenal karena kandungan gas alamnya yang tinggi. Huron Shale menjadi bagian dari Appalachian Basin yang selama ini menyuplai kebutuhan energi domestik di Amerika Serikat.

Huron Shale Map dan Distribusi Geologis

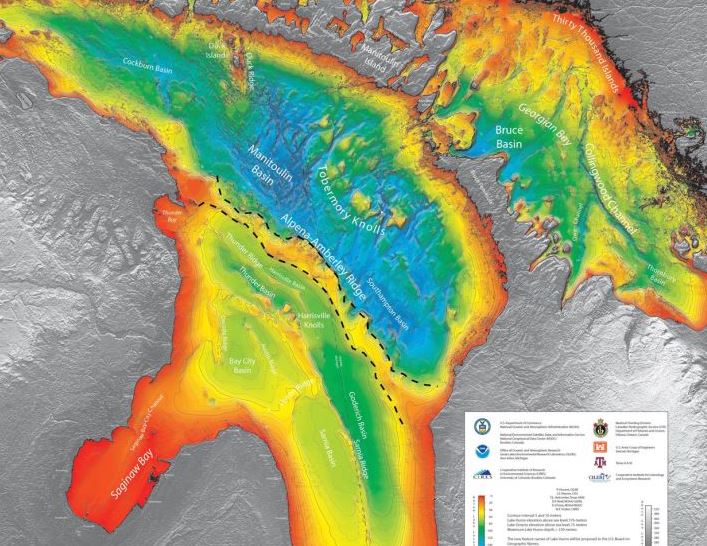

Peta sebaran menunjukkan bahwa formasi ini meluas ke Kentucky Timur, Ohio Selatan, dan bagian barat Virginia. Peta dan interpretasi geologi ini penting untuk memahami potensi sumber daya alam di bawah permukaan.

Peran Strategis Lower Huron Shale

Formasi ini memainkan peran penting dalam mengembangkan industri gas alam nonkonvensional di Amerika. Teknologi seperti fracking telah memungkinkan ekstraksi gas dalam jumlah besar dari formasi ini.

Dikutip dari USGS, total cadangan gas di Lower Huron Shale bisa mencapai lebih dari 6 Tcf (trillion cubic feet).

Kajian Ilmiah & Edukasi

Untuk memperluas pemahaman publik, artikel ilmiah dan pendidikan seputar Huron Shale kini tersedia di berbagai platform. Salah satunya adalah Sorot Edukasi, portal berita berbasis fakta yang juga mengangkat topik geologi, energi, dan kebijakan lingkungan.

🔗 Lihat Juga

- Oilshalegas.com | Portal Berita Bola

- Kategori Energi

- Kategori Olahraga & Bola

- Kepemilikan & Pendanaan

- Koreksi & Hak Jawab

- Etika Redaksi

- Keberagaman Konten

- Laporan Personalia

- Tentang Kami

- Kontak Redaksi

Temukan juga pembahasan mendalam seputar Marcellus Shale, Bakken Shale, dan Permian Basin di halaman-halaman kami lainnya.